When it comes to buying a car in the UAE, understanding auto financing options can be overwhelming, especially with the variety of loan types, interest rates, and eligibility requirements available. Whether you’re a first-time car buyer or someone looking to refinance your existing loan, having the right knowledge will ensure you make an informed decision.

In this blog, we will answer some of the most frequently asked questions (FAQs) about auto financing in the UAE to help you navigate the process with ease.

1. What is Auto Financing in the UAE?

Auto financing is a loan provided by a bank, financial institution, or car dealership to help you purchase a vehicle. The loan amount is typically repaid in monthly installments over a set period, usually 1 to 5 years, with interest charges applied by the lender.

2. What Are the Different Types of Auto Financing in the UAE?

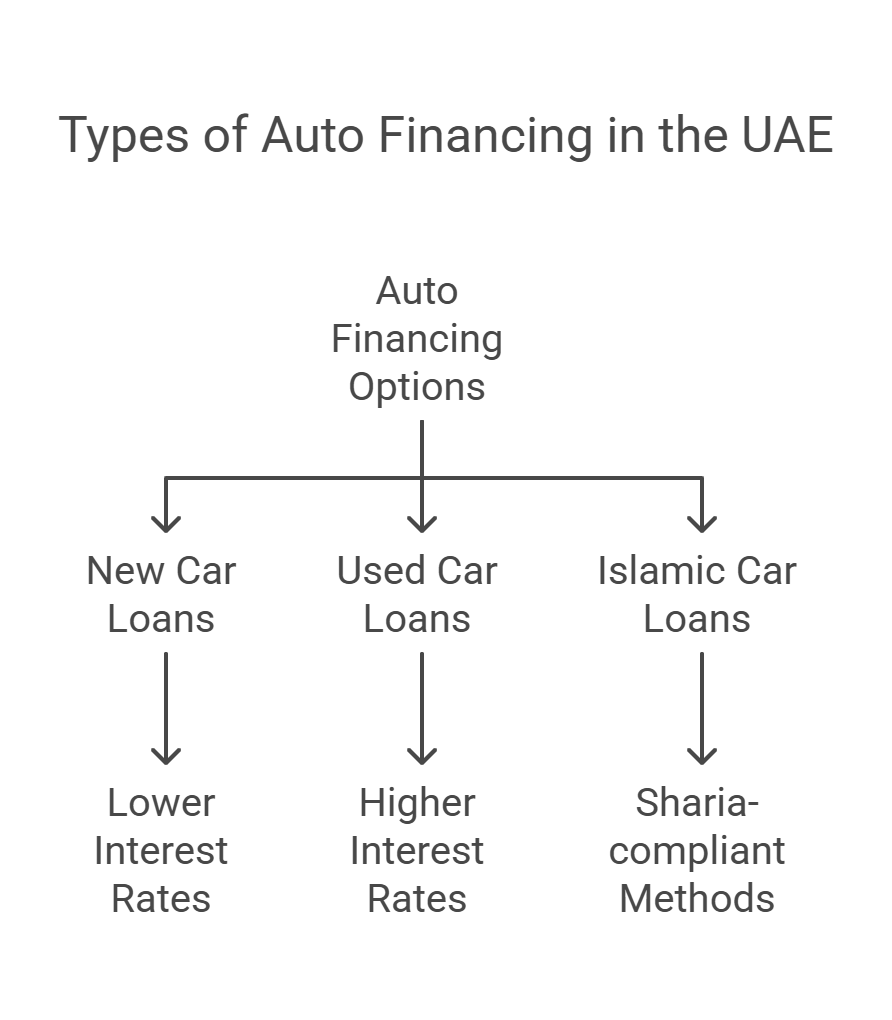

There are several types of car loans available in the UAE. The most common types include:

a. New Car Loans

These loans are for purchasing brand-new vehicles. They usually come with lower interest rates because new cars are less risky for lenders.

b. Used Car Loans

Loans for pre-owned vehicles, which may come with slightly higher interest rates due to the higher risk of depreciation and maintenance costs.

c. Islamic Car Loans (Sharia-compliant)

These loans are in compliance with Islamic principles and avoid interest-based lending. Instead, they use profit-sharing or leasing mechanisms to provide financing.

3. What Documents Are Required to Apply for an Auto Financing in the UAE?

To apply for an auto loan in the UAE, you will generally need to submit the following documents:

- Emirates ID: Proof of identity and residence in the UAE.

- Passport and Visa Copy: For non-residents, passport details and visa copy are required.

- Salary Certificate: A recent salary certificate from your employer to verify income.

- Bank Statements: Typically, 3-6 months of bank statements to assess your financial standing.

- Proof of Address: Utility bills or tenancy contracts to prove your current address.

- Car Quotation: A quotation or invoice from the car dealership for the vehicle you plan to purchase.

Some banks may require additional documents, so it’s a good idea to check with the lender in advance.

4. How Much Can I Borrow for a Car Loan in the UAE?

The amount you can borrow for an auto loan in the UAE depends on several factors, including:

- Your monthly income: Lenders typically approve loans that don’t exceed 20-30% of your monthly salary.

- Down payment: For new cars, banks require a minimum down payment of 20%, and for used cars, the minimum can be up to 40%.

- Credit score: A good credit score increases the chances of securing a larger loan.

- Car’s value: Banks usually finance up to 80-90% of the car’s value, but this varies based on the lender and type of vehicle.

5. What Are the Interest Rates for Auto Loans in the UAE?

Interest rates for car loans in the UAE vary depending on the bank, your credit score, and the type of loan. Typically, interest rates range from:

- New car loans: 2% to 4% per annum

- Used car loans: 3.5% to 6% per annum

If you are applying for an Islamic auto loan, the profit rate will be based on the type of financing agreement you enter into, such as Murabaha or Ijara.

It’s important to note that interest rates may also depend on the loan tenure, with shorter loan terms generally attracting lower rates.

6. How Long Can I Finance a Car in the UAE?

Auto loan tenures in the UAE typically range from 1 to 5 years. The length of your loan will impact your monthly payments and the total interest you pay:

- Short-term loans (1-3 years): Higher monthly payments, but lower total interest paid.

- Long-term loans (3-5 years): Lower monthly payments, but higher total interest paid over the loan’s lifetime.

It’s crucial to balance your monthly budget and long-term financial goals when choosing the loan tenure.

7. Can I Get a Car Loan Without a Salary Transfer in the UAE?

It is possible to get a car loan in the UAE without a salary transfer, but it can be more difficult to qualify. Many banks require that your salary be transferred to a bank in order to ensure regular repayments.

However, some financial institutions may still offer auto loans to self-employed individuals or people without a salary transfer, provided they have strong financial documentation (such as bank statements, proof of income, or a trade license for self-employed individuals).

8. Do I Need to Make a Down Payment for an Auto Loan in the UAE?

Yes, a down payment is required for most car loans in the UAE. The typical down payment is:

- For new cars: 20% of the car’s value.

- For used cars: 30-40% of the car’s value, depending on the car’s age, mileage, and condition.

The larger the down payment, the lower the loan amount you need, which can also reduce the amount of interest you will have to pay over time.

9. Can I Pay Off My Car Loan Early in the UAE?

Yes, most banks allow early repayment of car loans, but they may charge an early settlement fee. These fees can range from 1% to 3% of the remaining loan balance.

Before you make an early payment, it’s important to check with your lender about any fees or penalties. In some cases, paying off the loan early can help reduce the overall interest amount.

10. What Happens if I Miss a Payment on My Car Loan?

Missing a payment on your car loan in the UAE can have serious consequences, such as:

- Late payment fees: Banks typically charge a penalty for late payments.

- Higher interest rates: Some lenders may increase the interest rate on your loan after a missed payment.

- Impact on credit score: Missing a payment can negatively affect your credit score, making it harder to get loans in the future.

- Loan default: If payments are missed for an extended period, the bank can repossess the car.

It’s crucial to communicate with your lender if you foresee any difficulties in making your payments.

11. What Is the Best Way to Improve My Chances of Getting Approved for an Auto financing in the UAE?

Here are some tips to increase your chances of getting approved for a car loan in the UAE:

- Maintain a good credit score: A high credit score shows lenders that you are a reliable borrower.

- Ensure a stable income: A stable job with a steady income stream boosts your application.

- Save for a larger down payment: The larger your down payment, the less risk for the bank.

- Limit your existing debt: Banks prefer applicants with low levels of existing debt.

Conclusion

Auto financing in the UAE can seem complex, but understanding the common questions and concerns can simplify the process. By preparing the necessary documents, comparing loan options, and maintaining a strong credit profile, you can secure the best financing deal for your next vehicle purchase. Always ensure that you read the terms and conditions carefully and consult with a financial advisor if you’re unsure about any aspect of the loan process.

For Car Loans in Abu Dhabi, Ras al Khaimah and Al Ain Car Financing is possible via Auto Loan vehicle Services Like MyCarLoan.ae