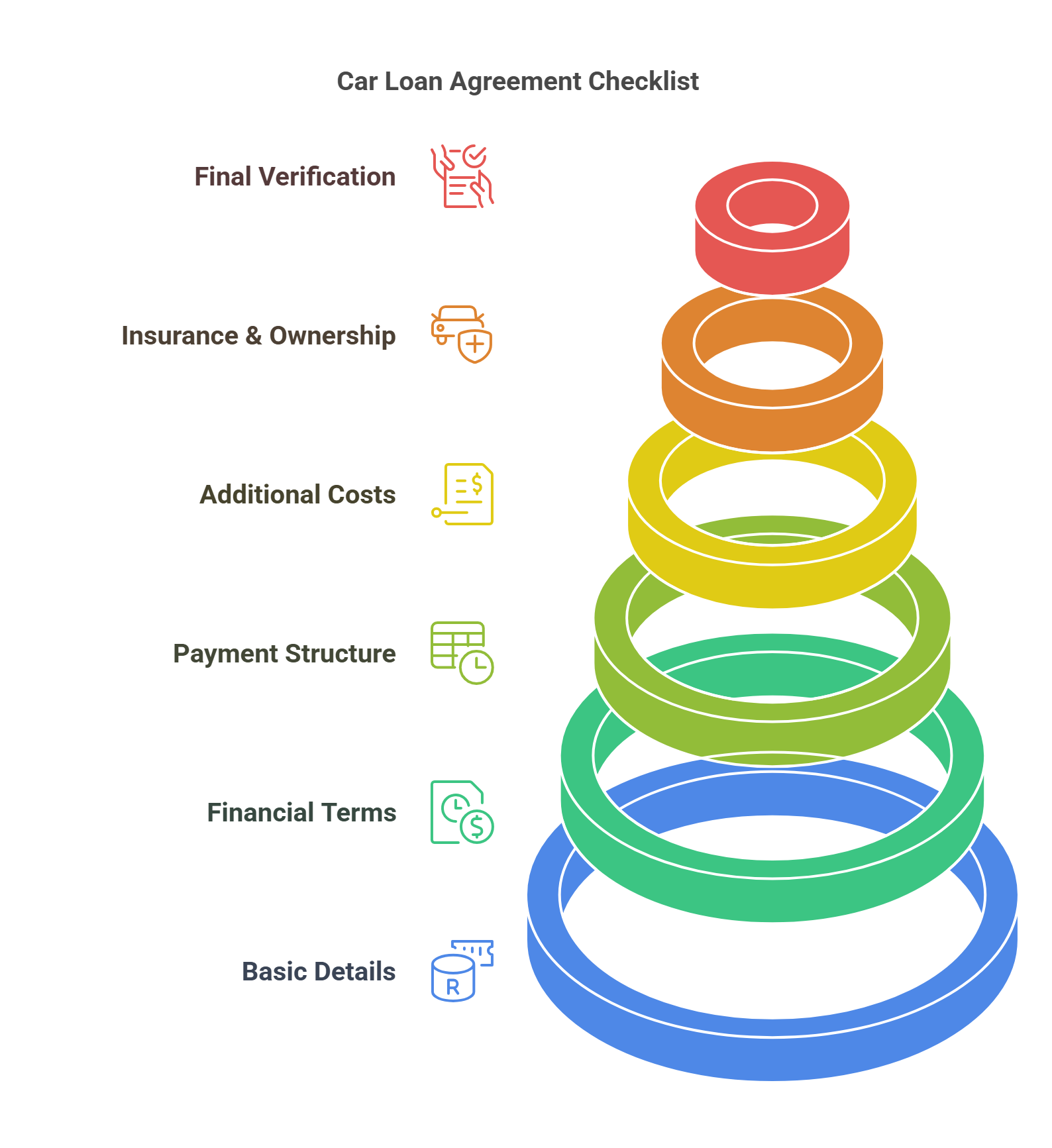

Securing a car loan in the UAE is a major financial commitment, and understanding the loan agreement is crucial to avoid unexpected costs. Whether you’re financing a new or used vehicle, reviewing the loan terms, interest rates, and repayment conditions ensures a smooth borrowing experience. A well-structured car loan can make vehicle ownership hassle-free, but failing to check hidden fees, penalties, or eligibility requirements could lead to financial stress.

This comprehensive car loan checklist will guide you through the essential steps to take before signing a car loan agreement in the UAE, helping you make a well-informed decision.

1. Verify Loan Amount and Vehicle Price for Car loan agreement

Before signing any loan agreement, make sure you’ve carefully reviewed the loan amount and vehicle price. Sometimes, additional costs or fees are bundled with the car’s price, and you may end up financing more than the actual car value.

Key Points:

- Loan Amount: Check that the loan amount aligns with the total cost of the vehicle after including taxes, registration, and other fees.

- Vehicle Price: Ensure the vehicle’s price matches the amount stated in the agreement and that it reflects any discounts or promotions you may have received.

2. Review the Interest Rate

The interest rate on your car loan is one of the most critical factors affecting the total amount you’ll pay over the loan term. Be sure to check whether the rate is fixed or variable and how it will impact your monthly payments.

Key Points:

- Fixed vs. Variable Rates: A fixed interest rate remains constant for the entire loan term, while a variable rate can change, affecting the amount you pay over time.

- APR (Annual Percentage Rate): This reflects the total cost of the loan, including both the interest rate and any associated fees, helping you better compare different loan offers.

Make sure the interest rate is competitive and aligns with current market rates.

3. Check the Loan Term

The loan term refers to the length of time you have to repay the loan. Loan terms in the UAE typically range from 12 months to 60 months or longer, and your monthly payments will vary depending on the term you choose.

Key Points:

- Short-Term Loan: While you’ll pay off the loan faster, your monthly payments will be higher, but you’ll pay less interest overall.

- Long-Term Loan: This results in lower monthly payments but a higher total interest cost over the life of the loan.

Ensure the loan term fits comfortably within your budget and aligns with your financial goals.

4. Understand Down Payment Requirements For Car loan agreement

The down payment is the amount you pay upfront toward the cost of the vehicle. Depending on the bank or lender, the down payment can range from 10% to 25% of the car’s value.

Key Points:

- Minimum Down Payment: Check the percentage of the down payment required by the lender and ensure you have enough funds available.

- Zero Down Payment Options: Some lenders may offer zero down payment loans, but be aware that these loans may come with higher interest rates or stricter eligibility criteria.

5. Clarify Monthly Payments and Payment Schedule

Make sure the monthly payment amount is manageable for your budget. It’s essential to have a clear understanding of how much you will need to pay each month and for how long.

Key Points:

- Affordability: Ensure the monthly payment fits comfortably within your income, considering your other financial obligations.

- Repayment Schedule: Double-check the exact payment due dates and whether the payment schedule is monthly or bi-monthly.

6. Review Prepayment and Penalty Terms

Check the terms regarding early repayment and penalties. Some banks may impose fees if you decide to pay off your loan early, while others might offer incentives for early settlement.

Key Points:

- Early Repayment Fees: Some lenders charge a fee if you pay off your loan before the agreed-upon term. Understand the terms surrounding early repayment and whether there is any flexibility to pay off the loan faster without incurring additional costs.

- Prepayment Discounts: In some cases, paying off the loan early might save you money on interest, so be sure to ask about any potential discounts for early settlement.

7. Verify All Fees and Additional Charges

In addition to the interest rate, there may be additional fees that come with the loan. Make sure you have a complete breakdown of all fees involved in the car loan process.

Key Points:

- Processing Fees: These are usually one-time fees for processing the loan application, which can range from 1% to 3% of the loan amount.

- Late Payment Fees: Understand the penalties for missing or delaying payments, as late fees can add up quickly.

- Documentation Fees: Some banks may charge for paperwork or administrative costs related to the loan.

8. Understand the Impact of Your Credit Score

Your credit score plays a vital role in determining the interest rate and loan amount you’re eligible for. A good credit score can help you secure a better interest rate, while a lower score may result in higher rates.

Key Points:

- Credit Score Requirements: Make sure your credit score meets the lender’s minimum requirements. If your score is lower than expected, you may want to consider taking steps to improve it before applying for a loan.

- Credit Score Impact: Understand how your credit score affects your loan terms and whether the lender may offer more favorable terms based on your creditworthiness.

9. Clarify the Insurance Requirements

In the UAE, it’s common for lenders to require comprehensive insurance for the vehicle as part of the loan agreement. This insurance ensures that the lender is protected in case of an accident or damage.

Key Points:

- Insurance Requirement: Check if the lender has specific insurance requirements, such as comprehensive car insurance.

- Insurance Cost: Ensure you can afford the insurance premiums, as this will be an ongoing cost throughout the life of the loan.

- Loan Protection Insurance: Some banks offer loan protection insurance that covers your loan in case of unexpected events, such as job loss or disability. Check if this is included or if it is an additional cost.

10. Verify the Ownership Transfer Process

Before signing the car loan agreement, make sure you understand how the ownership of the vehicle will be transferred to you.

Key Points:

- Collateral: In the case of a car loan, the vehicle itself acts as collateral. If you fail to make the payments, the lender has the right to repossess the car.

- Ownership Transfer: Clarify the process of transferring the car’s title and registration into your name and when it will happen.

11. Check the Loan Agreement’s Terms and Conditions

Before committing to anything, read through the loan agreement’s terms and conditions carefully. This includes all the fine print related to the loan, such as the rights and responsibilities of both parties involved.

Key Points:

- Understanding Terms: Ensure that you fully understand the loan’s terms before signing, including payment schedules, penalties, and the overall loan duration.

- Consultation: If anything is unclear, don’t hesitate to ask the lender for clarification or consult with a legal expert or financial advisor.

12. Make Sure All Agreements Are in Writing

All promises or agreements discussed during the loan negotiation should be documented in writing. Whether it’s a special discount, loan terms, or additional benefits, everything should be explicitly mentioned in the loan agreement.

Key Points:

- Written Agreements: Ensure that all verbal commitments from the bank or lender are included in the written agreement.

- Clear Documentation: Having a well-documented loan agreement helps protect both parties and ensures there is no ambiguity in the future.

Conclusion

Before signing a car loan agreement in the UAE, it’s essential to go through this checklist to ensure that you are fully prepared and aware of all aspects of the loan. From loan terms and interest rates to insurance requirements and hidden fees, understanding all the details will help you make an informed decision.

Taking the time to review the loan agreement carefully can help you avoid financial strain in the future and ensure that the loan aligns with your long-term financial goals.

For Car Loans in Abu Dhabi, Ras al Khaimah and Al Ain Car Financing is possible via Auto Loan vehicle Services Like MyCarLoan.ae