Wondering how to get pre-approved for a car loan in UAE? Getting pre-approved helps you understand your budget, interest rate, and repayment terms when buying a car. In this guide, we’ll walk you through each step—checking your credit score, gathering required documents, comparing lenders, and securing the best loan offer.

What Does Pre-Approval for a Car Loan Mean?

Banks review your financial profile during the pre-approval process to determine how much they can lend you for a car purchase. They offer specific terms, including the loan amount, interest rate, and repayment period, based on your financial situation.

Getting pre-approved does not mean you must borrow the full amount. Instead, it helps you define your budget and simplifies the car-buying process. With pre-approval, you gain a clear understanding of your loan eligibility, allowing you to confidently search for cars within your price range.

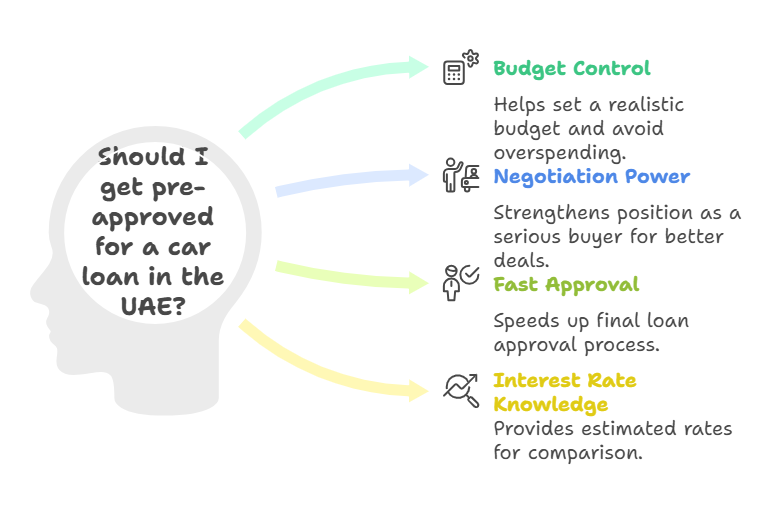

Why Should You Get Pre-Approved for a Car Loan in the UAE?

1. Gain Better Control Over Your Budget

Pre-approval helps you set a realistic budget by determining how much you can borrow. It prevents overspending and ensures that you can comfortably afford the monthly payments. As a result, you can focus on vehicles within your budget and avoid financial surprises during the purchase.

2. Strengthen Your Negotiation Power

With a pre-approved loan, dealerships recognize you as a serious buyer. This gives you a strong negotiating advantage since sellers know you already have financing in place. As a result, you may secure better deals, such as discounts, extra features, or additional incentives.

3. Speed Up the Approval Process

Since you have already completed the pre-approval stage, final loan approval happens much faster once you choose a car. This eliminates long waiting periods and allows you to complete the purchase quickly.

4. Know Your Interest Rate in Advance

Pre-approval gives you an estimate of the interest rate, helping you compare different lenders. This ensures that you secure the best possible deal based on your financial situation.

How to Get Pre-Approved for a Car Loan in the UAE: Step-by-Step Guide

Step 1: Check Your Credit Score

Your credit score is one of the most important factors that lenders use to evaluate your loan application. In the UAE, credit scores are provided by Al Etihad Credit Bureau (AECB). A higher credit score increases your chances of getting pre-approved for a car loan and securing a better interest rate.

How to Check Your Credit Score:

- Request your credit report from the AECB website.

- Review your credit history for any inaccuracies that could affect your score.

- If your score is low, you may want to improve it by paying off outstanding debts and making timely payments on your existing loans.

Step 2: Gather Required Documents

To get pre-approved for a car loan, you’ll need to provide certain documents to the lender. These documents help the bank assess your financial situation and determine how much you can borrow. Make sure you have all the following documents ready:

- Emirates ID (for UAE nationals or residents)

- Valid passport (for expats)

- Residency visa

- Salary certificate or pay slip (to prove your income)

- Bank statements for the last 3-6 months

- Credit report from the AECB

- Employment details (e.g., company name, position, length of employment)

- Proof of address (utility bills or tenancy contract)

Having these documents ready will speed up the pre-approval process.

Step 3: Choose the Right Lender

The next step is to choose the lender or financial institution where you will apply for the car loan. There are many options in the UAE, including local banks, international banks, and non-banking financial institutions (NBFIs).

When choosing a lender, consider the following factors:

- Interest Rates: Compare the interest rates offered by different lenders. A lower interest rate will save you money in the long run.

- Loan Terms: Look for flexible loan terms, including repayment periods and monthly installment options.

- Processing Fees: Some lenders charge processing fees, so make sure to account for any additional costs.

- Customer Service: Choose a lender known for excellent customer service and easy communication.

Many banks in the UAE offer online pre-approval services, where you can fill out an application form, upload your documents, and receive a decision quickly.

Step 4: Apply for Pre-Approval

Once you have all your documents ready and have selected the lender, you can apply for pre-approval. Most banks offer an easy online application process. You may be required to fill out a loan application form, submit the necessary documents, and agree to a credit check.

Some banks also allow you to get instant pre-approval if you meet the necessary criteria. This process can usually be completed in a few hours or days, depending on the lender and the complexity of your financial situation.

Step 5: Review the Pre-Approval Offer

After submitting your application, the bank or lender will evaluate your financial details and provide you with a pre-approval letter. This letter will include:

- The approved loan amount

- Interest rate

- Repayment term

- Monthly installment

- Any additional fees or charges

Review the offer carefully to ensure it aligns with your financial capabilities. If you have any questions or concerns, reach out to the lender for clarification before accepting the offer.

Step 6: Visit the Dealership and Finalize the Loan

Once you have your pre-approval letter, you can start shopping for a car. Having pre-approval gives you confidence in your budget, so you can focus on finding the right car within your price range.

Once you choose a car, return to your lender to finalize the loan details. You’ll need to provide the final details of the car you plan to buy, including its price and any additional costs like insurance. You can sign the agreement, and proceed with the car purchase after the loan is finalized.

Tips for a Successful Pre-Approval Process

- Ensure a Good Credit Score: A higher credit score makes it easier to get pre-approved with favourable terms.

- Pay Down Existing Debts: Reducing your current debt levels can improve your chances of loan approval.

- Be Honest on Your Application: Always provide accurate financial information to avoid complications during the pre-approval process.

- Understand the Total Cost: Ensure you factor in all costs, such as insurance and registration fees, when determining your budget.

Conclusion

Getting pre-approved for a car loan in the UAE is a smart step to take when buying a vehicle. It helps you set a realistic budget, strengthens your negotiating position, and speeds up the car purchasing process. By checking your credit score, gathering the necessary documents, and comparing different lenders, you can ensure a smooth pre-approval process and secure a loan that works best for you.

Pre-approval is an excellent tool for buyers looking for financial clarity and a streamlined car-buying experience in the UAE. By following the steps above, you can be confident that you are making an informed decision and can drive away in the car of your dreams.

For Car Loans in Abu Dhabi, Ras al Khaimah and Al Ain Car Financing is possible via Auto Loan vehicle Services Like MyCarLoan.ae